For those venturing into life or business in Portugal, the Número de Identificação Fiscal (NIF) is a must-have document that you should start to think about. Much like a British National Insurance number or an American Taxpayer Identification Number (TIN), the Portuguese NIF is a unique taxpayer identifier, pivotal for everything from opening a bank account to purchasing property. While it is straightforward in concept, obtaining a NIF requires an understanding of Portugal’s bureaucratic processes, particularly for non-residents who may find themselves in need of a tax representative.

It is important to understand that the NIF is not just a number; it is your gateway to the formal financial and legal systems in Portugal. Issued by the Portuguese Tax and Customs Authority (Autoridade Tributária e Aduaneira), this number is required for conducting a broad range of activities in the country. From buying a home to signing up for utilities, nearly every significant transaction in Portugal will require you to presente this number. The good news is that getting a NIF is not as daunting as it may seem, particularly if you enlist professional assistance, as we will explain.

Who Requires a Portuguese NIF?

The NIF is essential for both residents and non-residents looking to work, set up a business, invest, or simple live in Portugal. Essentially, anyone engaging in financial transactions or dealing with tax-related matters must acquire one. For instance, British citizens eyeing a property purchase in Lisbon, retirees seeking the warm climate, and business investors alike will all need to obtain this number as a first step.

Interestingly, the requirement extends to individuals who are simply looking to open a bank account in Portugal. While the process is often swifter for Portuguese residents, non-residents can also apply with professional help, or the aid of a Portuguese citizen to be their representative. The NIF ensures the Portuguese tax authority can monitor financial activities, but it is also an invaluable tool for accessing services and securing your presence within Portugal’s formal system.

Do Non-Residents Need a NIF?

Yes, any foreign individual, whether resident or non-resident in Portugal, who works and pays taxes in the country, must have a Tax Identification Number (NIF). Non-residents, including EU citizens—or anyone outside of Portugal—often need a NIF to accomplish the simplest of tasks, such as signing a rental lease or arranging utility services. Although, if you are a tourist, the NIF would not be necessary for activities like getting a hotel booking or renting a car.

Many expats find it advantageous to use a service provider, especially those who need to satisfy requirements remotely. Having a professional handle these steps on your behalf saves time and keeps you in compliance with Portuguese regulations.

Why is the NIF Important in Portugal?

The Portuguese NIF is more than just a tax number; it is essentially your ticket to navigating the Portuguese system. Imagine arriving in a new country, eager to settle down or set up your investment, only to find that without this nine-digit number, much of your plans would grind to a halt. With a NIF, you would be able to open a bank account, sign contracts, apply for utilities, and even access the universal healthcare services in some instances. Beyond its functional benefits, the NIF is also a regulatory instrument used by the government. By requiring a NIF for significant transactions, Portuguese authorities ensure transparency and accountability in financial dealings. While many locals might take this number for granted, for foreigners and new residents, it is a gateway that signals your official entry into the country’s legal and financial landscape.

How to Obtain a Portuguese NIF?

Applying for a Portuguese NIF is usually a straightforward process for residents, though non-residents might find it trickier. To obtain a NIF, you can visit a local Finanças office with the necessary documents, or if you are not currently in Portugal, you can point out a representative. Non-EU citizens are required by law to have a tax representative, so if you are applying from outside the EU, this is a step you cannot bypass.

It is worth noting that before heading to the finance office, you should book an appointment for in-person assistance through the Call Centre (CAT) on 217 206 707, available on weekdays from 9am to 7pm.

If you would rather sidestep all this hassle, you can obtain your NIF through a fiscal representative. Portugal Homes, for example, has a dedicated department— the After Sales—that provides hands-on support, handling both tax representation and documentation. With this service, you are spared the bureaucratic headaches and can rest assured that everything is compliant with Portuguese tax regulations. Not only our professionals will assist in securing your NIF, but they will also offer guidance on maintaining your tax status once it is in place.

What Documentation is Required?

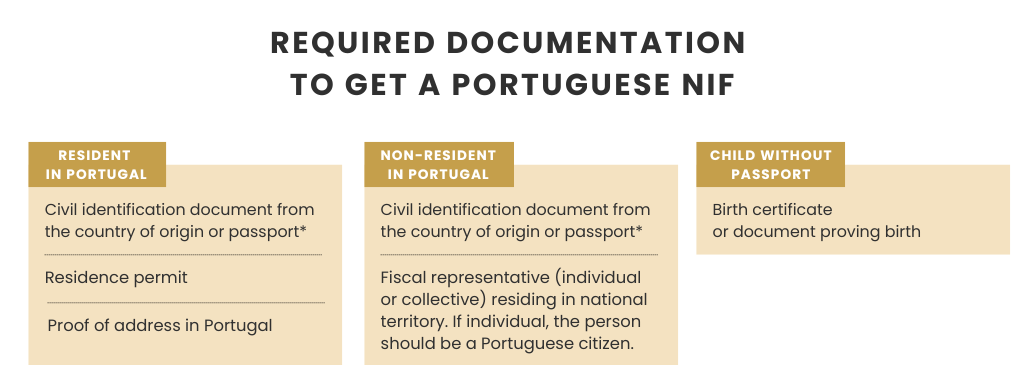

When applying for a NIF, the documentation you will need depends on your residency status. Portuguese residents should bring their passport or national ID, alongside proof of Portuguese residency, such as a recent utility bill or rental contract registered at the Finanças (local Tax Office). For non-residents, the requirements include a passport and proof of address from your home country, plus details of your appointed tax representative.

For non-EU citizens, a tax representative is essential, as this individual or entity will act on your behalf in Portugal, liaising with the tax authorities and ensuring you meet all obligations. Many non-residents enlist a professional service to avoid potential issues, particularly those unfamiliar with Portuguese administrative procedures.

*If presenting a passport, you must also provide a visa for entry into Portugal or the Schengen Area.

NIF vs. NISS: What is the Distinction?

The NIF is often confused with the Social Security Identification Number (NISS), but the two are distinct. While the NIF pertains solely to tax-related matters, the NISS is issued by the Social Security system and is required for employment, pensions, and social benefits. A Portuguese resident may hold both, as they serve different purposes within the country’s framework. For anyone looking to work, the NISS is indispensable, while the NIF covers the scope of tax obligations and formal financial transactions.

For those considering Portugal for business or residency, both numbers will likely be essential. However, if your primary focus is investment or financial transactions, then the NIF alone will suffice.

Is a NIF Necessary for Residency by Investment in Portugal?

Absolutely. For residency by investment - be it through Portugal’s Golden Visa programme or D2 Visa - a NIF is a crucial piece of the puzzle. The NIF allows you to manage the financial transactions required to fulfil investment criteria, such as setting up a bank account or completing property purchases. For those looking to establish themselves in Portugal, securing a NIF is among the first steps in the residency process, facilitating your legal and financial commitments within the country.

This identification number is critical for expediting applications and staying on track with your investment goals. Without it, even basic processes such as setting up an account to transfer funds become a challenge.

Costs of Obtaining a NIF in Portugal

If you apply for a NIF yourself, the process is generally free at the Portuguese tax office. However, non-residents who require a tax representative may incur service fees, depending on the provider they choose. Engaging a professional can be advantageous, particularly for those new to Portuguese systems or applying remotely. Many expats find it worthwhile to pay a small fee for the peace of mind that a representative provides.

Costs can vary widely, so it is advisable to research providers and review their services carefully. A reputable representative will ensure not only that you obtain your NIF smoothly but also that you understand any tax obligations and potential liabilities.

Tax Responsibilities with a Portuguese NIF

Possessing a NIF brings certain responsibilities, especially if you are earning income in Portugal. With a NIF, you are registered in the tax system, which means the Portuguese authorities may expect you to fulfil obligations, such as filing annual returns, depending on your residency and income status. If you own property, rent it out, or run a business, you will need to be aware of tax regulations tied to these activities.

Annual tax returns are mandatory for residents, and even non-residents may have reporting obligations if they earn income from Portuguese sources. For those navigating these waters, a tax advisor or representative can be invaluable in keeping you in good standing with local authorities. If this is something that you may need, keep in mind that the Portugal Homes’ After Sales department offers Tax Representation services, a real advantage for overseas clients. This support helps you manage this essential process efficiently, allowing you to make the most of your time in Portugal.

FAQs

How Does a Portuguese Tax Card Differ from a NIF Number?

The NIF number itself is what holds significance, rather than the physical card it may be printed on. While some may carry a tax card, possessing the NIF number alone is sufficient for transactions.

How Long Does It Take to Receive a NIF?

When applying in person at a Portuguese tax office, you can often receive your NIF on the same day. However, for online or postal applications, particularly those involving a tax representative, the timeline may extend from a few days to a few weeks.

What is a Tax Representative?

A tax representative is a designated person or entity that acts on behalf of non-residents in dealings with Portuguese tax authorities. They ensure tax compliance and act as your contact point within the Portuguese tax system.

Is a NIF Required for a Golden Visa?

Yes, obtaining a NIF is a requirement for Portugal’s Golden Visa programme. It enables you to undertake financial activities tied to your investment and residency, from setting up a local bank account to securing real estate purchases.