Portugal, with its stunning landscapes, rich cultural heritage, and a quality of life that ranks among the best in the world, has long been an attractive destination for foreigners. Over recent years, this appeal has only grown stronger as the country has become a hub for expats, entrepreneurs, retirees, and young professionals alike. To make homeownership more accessible and affordable for young adults under the age of 35, the Portuguese government has introduced new tax exemptions on IMT (Imposto Municipal sobre Transmissões) and IS (Imposto de Selo). This strategic initiative should also further solidify the country’s position as a top choice for international investors, as people from any nationality can be eligible the exemptions.

Understanding IMT and the Housing Market in Portugal

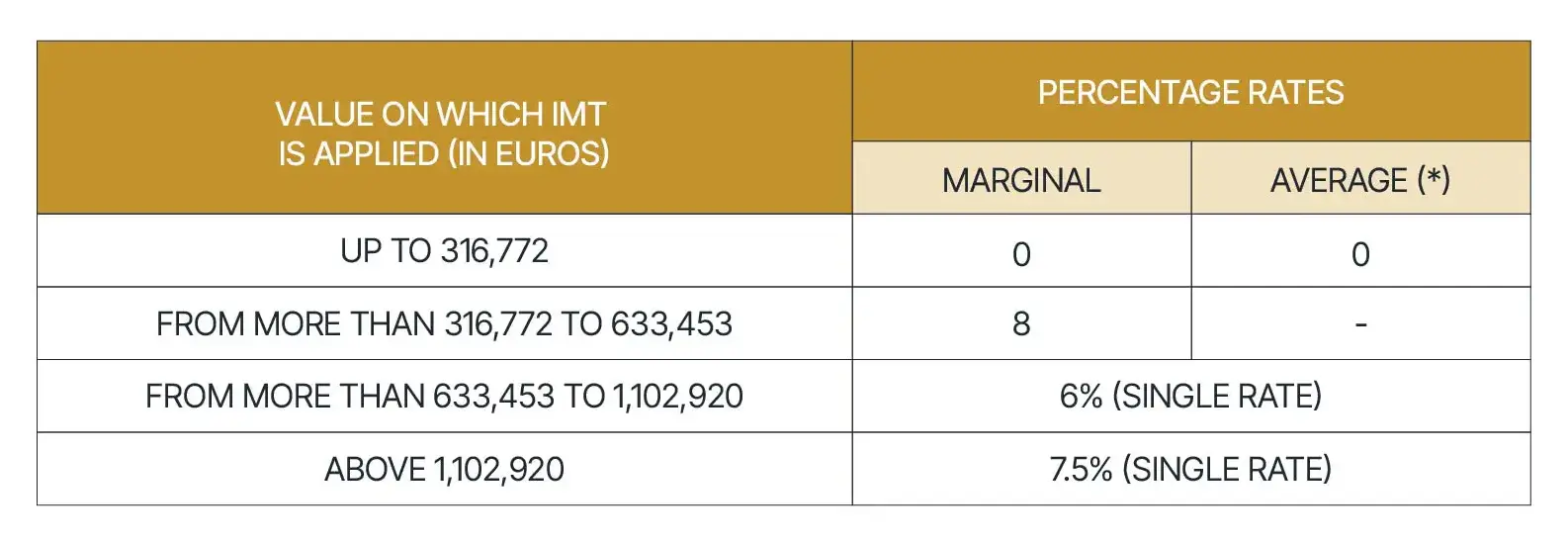

Before diving into the details of the new tax exemptions, it is important to grasp the significance of IMT in the context of Portugal's real estate market. IMT, or the Municipal Property Transfer Tax, is a tax that buyers must pay when purchasing property in Portugal. The rate of this tax varies depending on several factors, including the value of the property, its location, and whether the buyer intends to use it as their primary and permanent residence. Typically, the IMT rate can range from 0% to 8%, making it a substantial part of the overall cost of purchasing a home.

In recent years, the Portuguese real estate market has experienced significant growth, driven by both domestic demand and international investment. Cities like Lisbon, Porto, and the Algarve region have seen property prices surge as they become increasingly popular with foreign buyers. However, this rise in property values has also led to higher costs of living and increased barriers to homeownership, particularly for younger individuals who may not have the financial resources to compete in such a competitive market.

The Strategic Aim of the IMT and IS Tax Exemptions

The impact of these exemptions can be substantial. For instance, if a person under 35 years old purchases a property valued at €300,000 in Lisbon, the standard IMT could be around €8,000. With the exemption, this amount is effectively removed, making the purchase of the property much more manageable. Similarly, the IS, which is typically 0.8% of the property's value, would also be waived, saving an additional €2,400 in this scenario. These savings make a tangible difference, particularly for young professionals who might be juggling student loans or other financial obligations.

Who is Eligible for the IMT and IS Tax Exemptions

IMT and IS exemption eligibility primarily extends to people aged 35 or younger at the time of property acquisition. The exemption applies specifically to the first purchase of a property intended as a primary and permanent residence. If a person or couple meets these criteria, they may be eligible, although the exemption is limited to properties valued up to €316,772. For properties valued between €316,772 and €633,453, the exemption only covers the first €316,772, with taxes applied to the remaining amount.

The exemption has additional stipulations. If one already owns part of a residential property, regardless of how it was acquired (even if inherited from a family member), they are not eligible for the exemption on a subsequent purchase. Couples in which only one partner meets the age or ownership conditions can still partially benefit, but only on the share acquired by the eligible partner – or so, the couple would benefit only of 50% tax exemption. The exemption is available to all qualifying individuals, irrespective of nationality, as long as the legal conditions are satisfied.

Promoting a Youthful International Demographic in Portugal

The broader objective of these exemptions extends beyond mere financial relief. By making it easier for a person under 35 years to buy a home, the Portuguese government is strategically positioning the country as an attractive destination for a younger, more dynamic international population. This is particularly important in light of the demographic challenges facing many European countries, where aging populations and declining birth rates pose long-term economic risks.

Additionally, the influx of young, foreign professionals is likely to have a positive impact on the housing market itself. While the initial intent of the exemptions is to make homeownership more accessible, the increased demand from this demographic could stimulate further development of residential properties, particularly in urban centres and emerging neighbourhoods. This, in turn, could lead to more balanced growth in property values, benefiting both buyers and the real estate market as a whole.

The Portuguese Real Estate Market with Expert Guidance

While the IMT and IS tax exemptions offer significant advantages, navigating the complexities of the Portuguese real estate market can still be a complex task, particularly for those unfamiliar with local regulations and procedures. This is where professional assistance becomes invaluable. At Portugal Homes, we specialise in helping foreign residents make informed decisions about their real estate investments in Portugal. Our comprehensive tax representation services are designed to ensure that you fully benefit from available exemptions and avoid any potential pitfalls.

From understanding the nuances of the IMT and IS exemptions to identifying properties that meet your specific needs and budget, our team of experts is here to guide you every step of the way. We offer a wide range of services, including property search, legal assistance, and our unique after sales support, a tailored service that helps overseas clients with tax representation, bank account opening – both necessary for a property purchase –, and later on, property concierge and management.

Portugal Homes’ portfolio of properties includes everything from chic urban apartments in Lisbon and Porto to serene coastal retreats in the Algarve. Whether you are looking to invest in a bustling city centre in spots like Lisbon and Porto or a tranquil beach front view in the Algarve, we can help you find the home that perfectly aligns with your lifestyle and financial goals.

The decision to purchase property in Portugal is not just about finding a place to live; it is an investment in your future. The country’s stable economy, favourable tax regime, and high quality of life make it an attractive option for long-term residence and investment. By taking advantage of the IMT and IS exemptions, young foreign under 35 years can maximise the return on their investment while securing a foothold in one of Europe’s most desirable destinations.

Read more:

Buying Property in Portugal as a Foreigner in 2025: The Ultimate Guide

Portuguese IMT and IS Tax Exemptions: Frequently Asked Questions

Is the IMT and IS exemption also applicable to foreigners?

Yes, the exemption is available to all young people who meet the legal conditions, regardless of their nationality.

Does the exemption from IMT and IS apply from the date of publication of the Decree-Law, or from 1 August 2024?

The exemption from IMT and IS applies to all property purchases made on or after 1 August 2024, as announced by the Portuguese Government.

I am 35 years old. The measure has been presented as applicable to young people up to 35 years old. Am I still eligible?

Yes, you are still eligible. The exemption applies to anyone who is 35 years old or younger at the time of purchasing the property.

I currently own a property that is my primary and permanent residence. Am I entitled to the exemption?

No, the exemption is only available for the first purchase of a property intended to be your primary and permanent residence. If you already own a primary residence, you are not eligible.

We are a couple, and one of us already owns a residential property. If we buy a house together for our primary residence, will we be entitled to the IMT and IS exemption?

In this case, the exemption will apply only to the portion of the property being acquired by the partner who does not currently own a residential property and is under 35 years, which is typically 50%.